The Stock Market

- frugal.zoomer

- Jun 7, 2020

- 2 min read

Updated: Jun 17, 2020

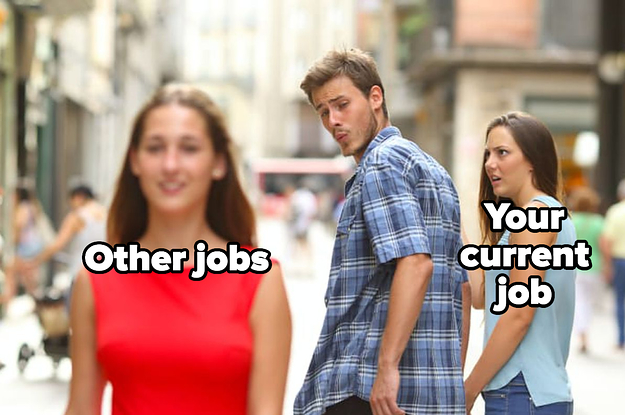

If this is what you think of when I say the words stock market, then you're not the only one.

As movies like The Wolf of Wall Street and The Big Short show, the stock market is a messy, convoluted, complicated, abstract place that is filled with corruption and fraud.

But it's also the only place you'll want to put your money if you have any hopes of beating inflation and retiring someday.

The stock market is the place where individuals and companies meet up to buy and sell stocks (shares of a company). The physical location where these transactions occur are called exchanges. You've probably heard of a few: the New York Stock Exchange (NYSE) and Nasdaq, to start. There are 60 major stock exchanges throughout the world. Most are entirely electronic at this point.

Companies can choose to "go public", or sell shares of their stock on the exchange, through an Initial Public Offering (IPO). Investors purchase these shares, which gives the company more money to grow, which can return profits to the investors. Of course, investors can choose to sell their shares or buy more at any time.

We can judge the current state of the stock market by looking at indexes, or groups of stocks that represent some subset of the entire market. Some indexes you may have heard of are the Standard & Poor's 500 (S&P 500), the Dow Jones Industrial Average (DJIA), and Nasdaq. The S&P 500 is a collection of, you guessed it, the five hundred largest companies in the U.S. The DJIA contains 30 company's stocks, and Nasdaq contains 4000+.

There are also more specific indexes, such as ones for the biotechnology, semiconductor, telecommunication, and banking industries. You cannot invest directly in an index, however you can easily find ETFs and mutual funds that are meant to follow each one.

In order to invest in the stock market in any way (see this article for ideas!), you'll need a brokerage account through a broker. A broker is the intermediary between an investor (you) and the exchange. They used to be stressed-out white men on Wall Street, screaming "BUY BUY BUY" or "SELL SELL SELL", but today a broker usually comes in the form of a brokerage account through a site like Fidelity or Vanguard. This page at Nerdwallet compares and contrasts the 11 most popular online brokers. Brokers typically charge a fee, called a commission, when you complete a purchase through them.

Hypothetically, you could still trade on the stock market without a broker. However, brokers provide resources to build, track, and manage your portfolio. Plus, the stock exchange doesn't enjoy getting phone calls from millions of Americans. Online brokers streamline the process and communicate with the exchanges so you don't have to. They are user-friendly and help you make good decisions about investments, typically for free (unless you want the help of a financial advisor).

Now that you understand how the stock market works, you're ready to go find a broker, roll up your sleeves, and buy some stocks!

Comments